The Power Trading Process

Process walkthrough of the UK power trade lifecycle and supporting systems.

Quick takeaways:

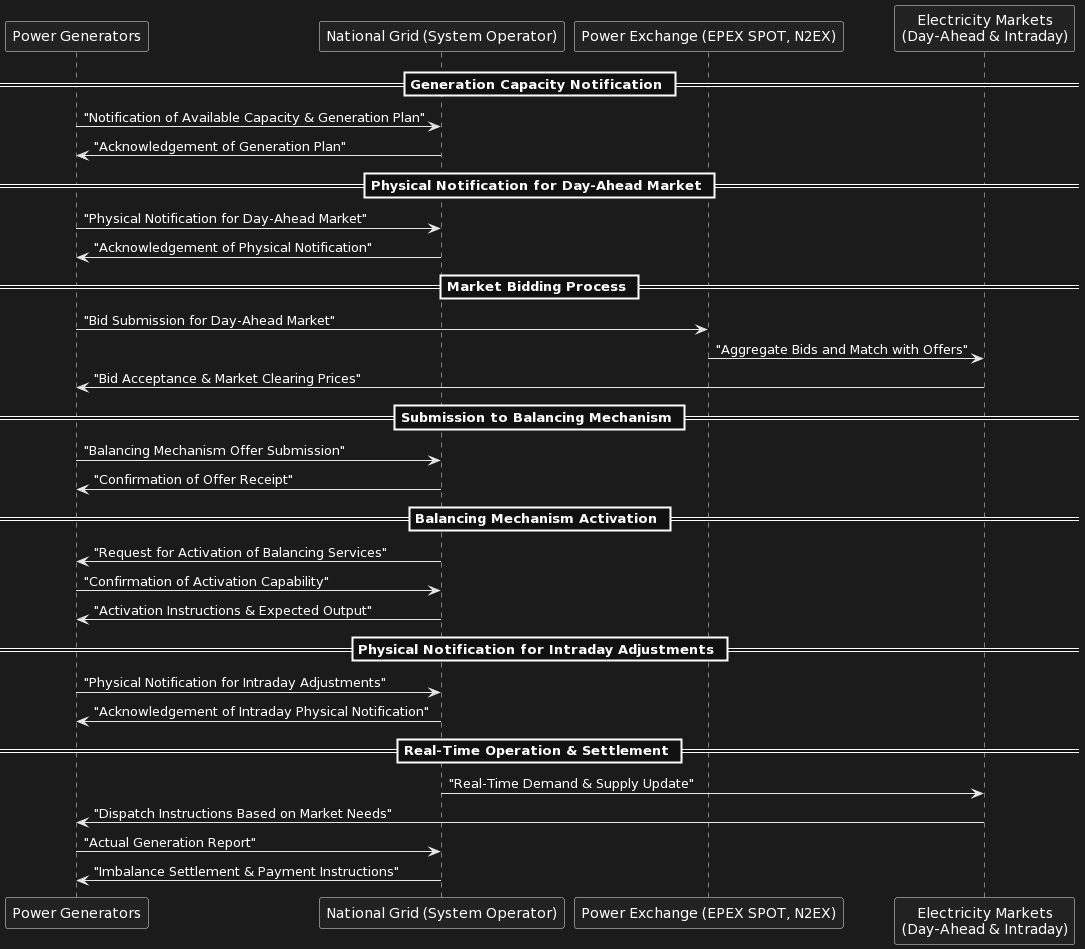

- Visualises the UK balancing mechanism and the scheduling lifecycle for power trades.

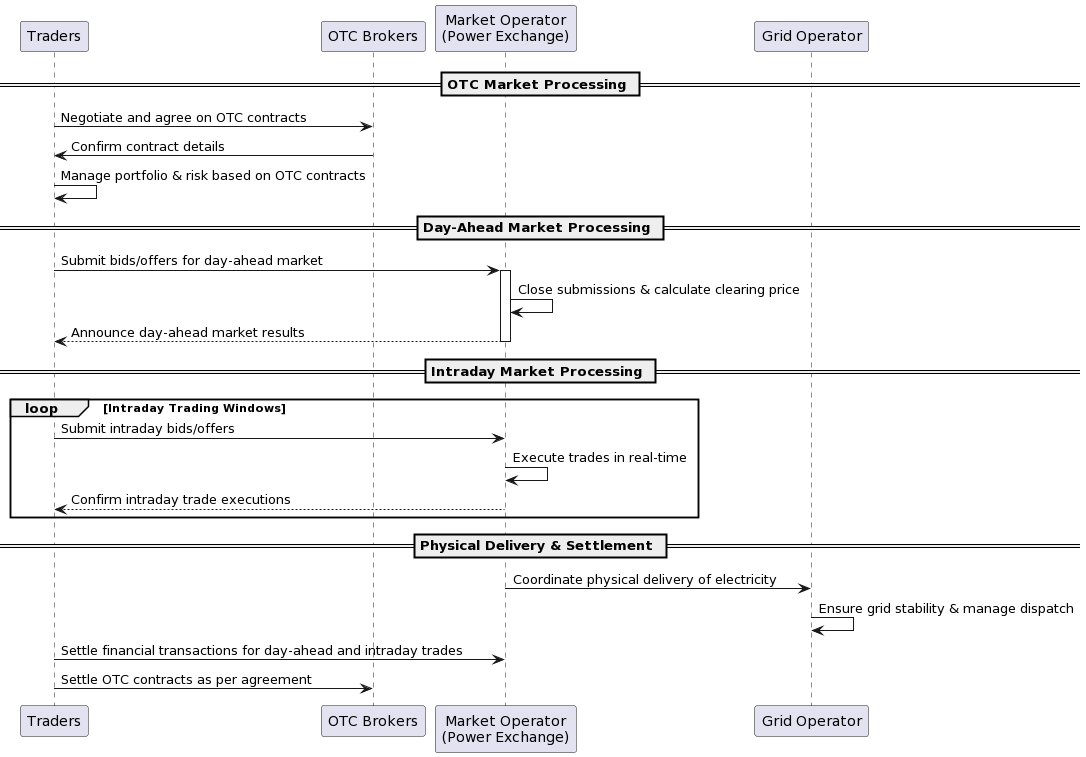

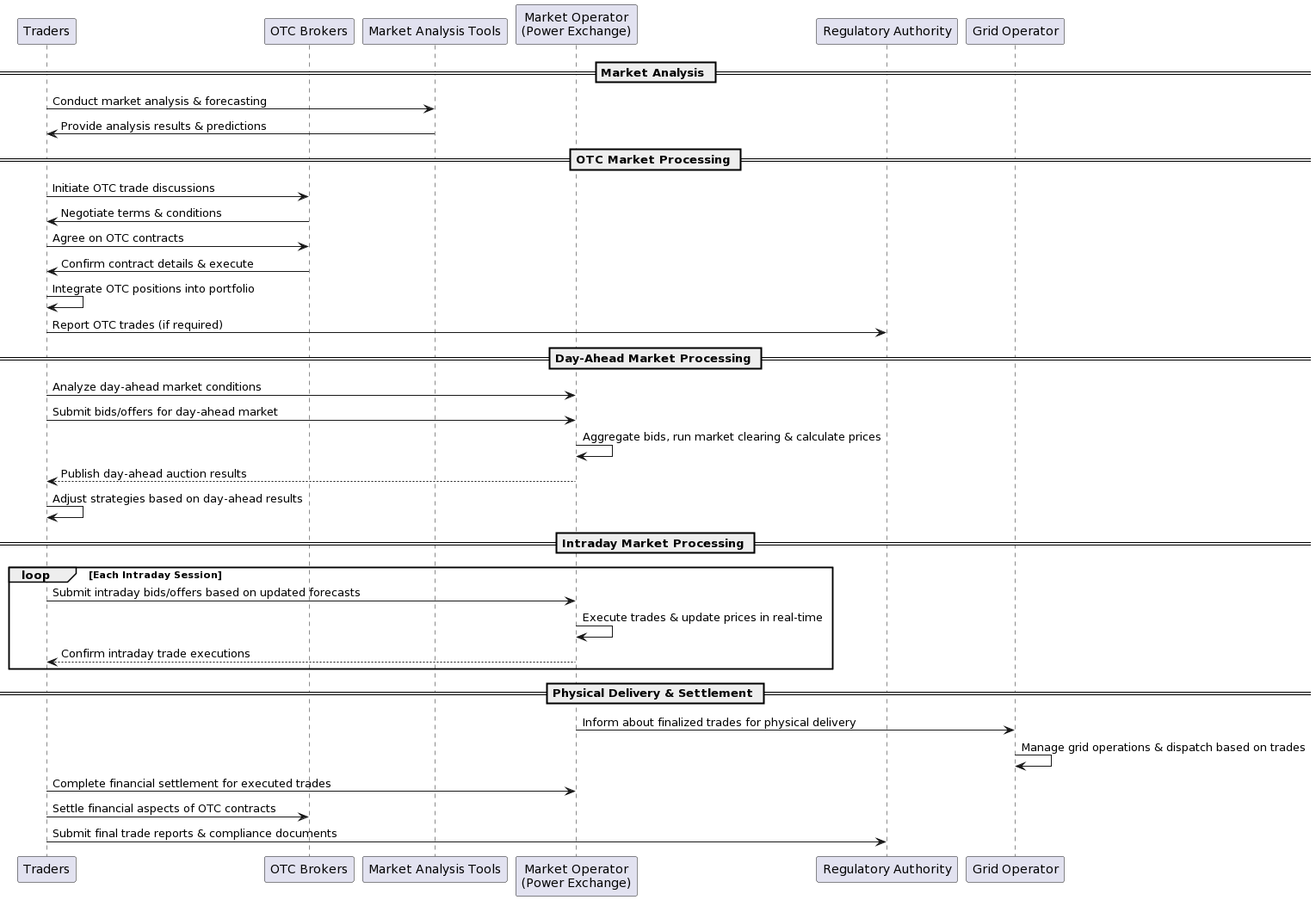

- Explains how OTC, day-ahead, and intraday processes connect across the market stack.

- Shows automation opportunities and supporting systems for trading, operations, and settlement.

Power trading combines commercial decision making with tightly controlled market operations. The diagrams below outline the market landscape, scheduling flows, and automation touch points typically encountered by utilities and energy traders.

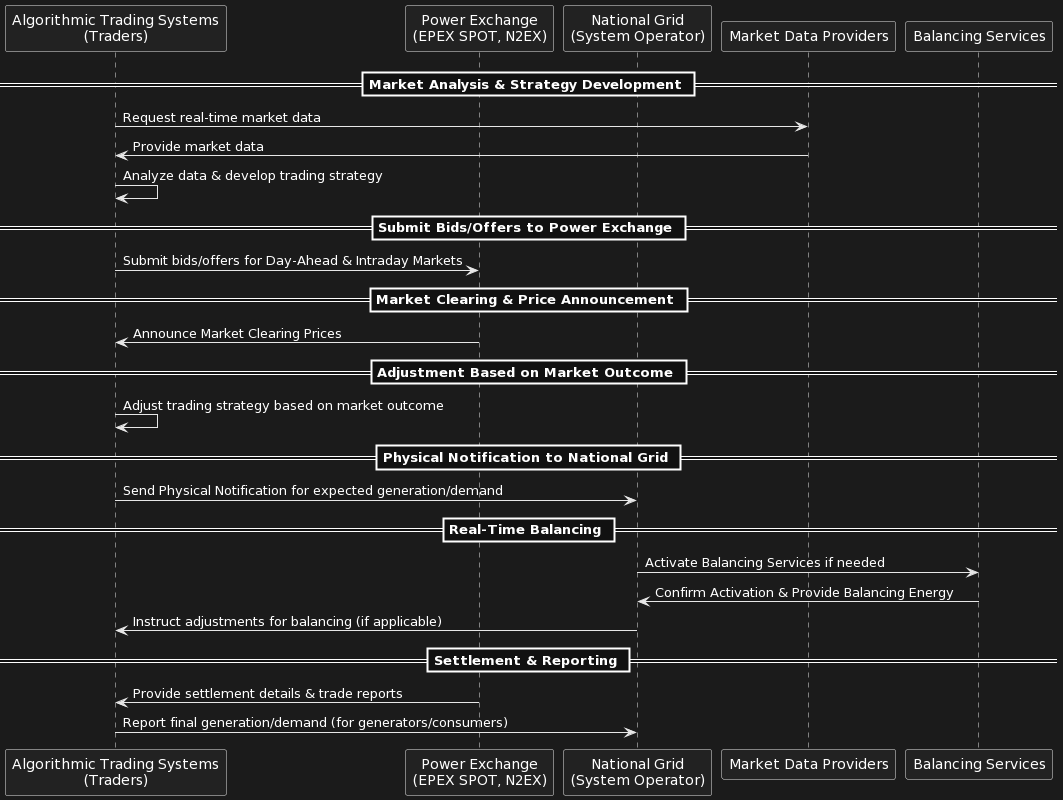

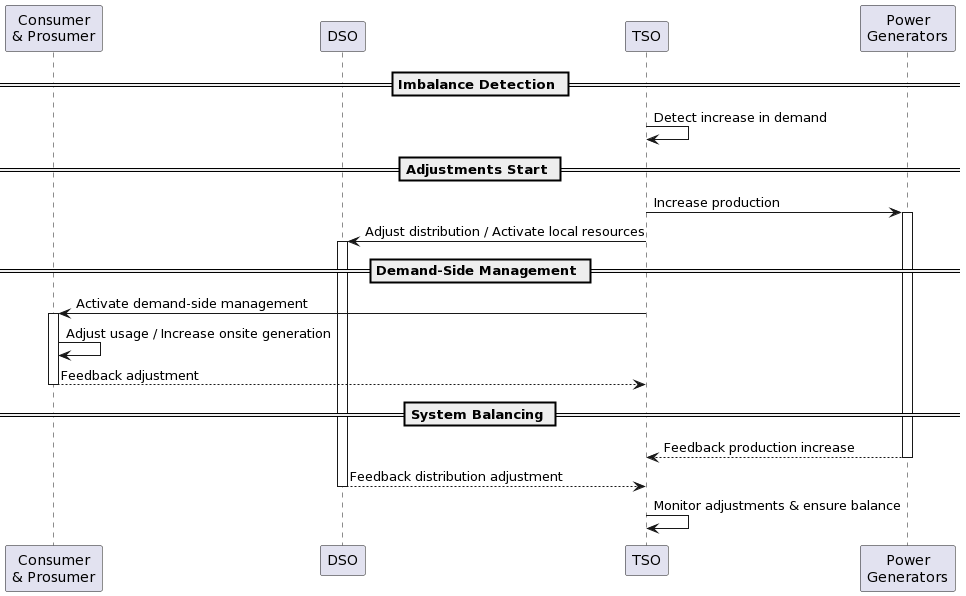

Balancing the Market

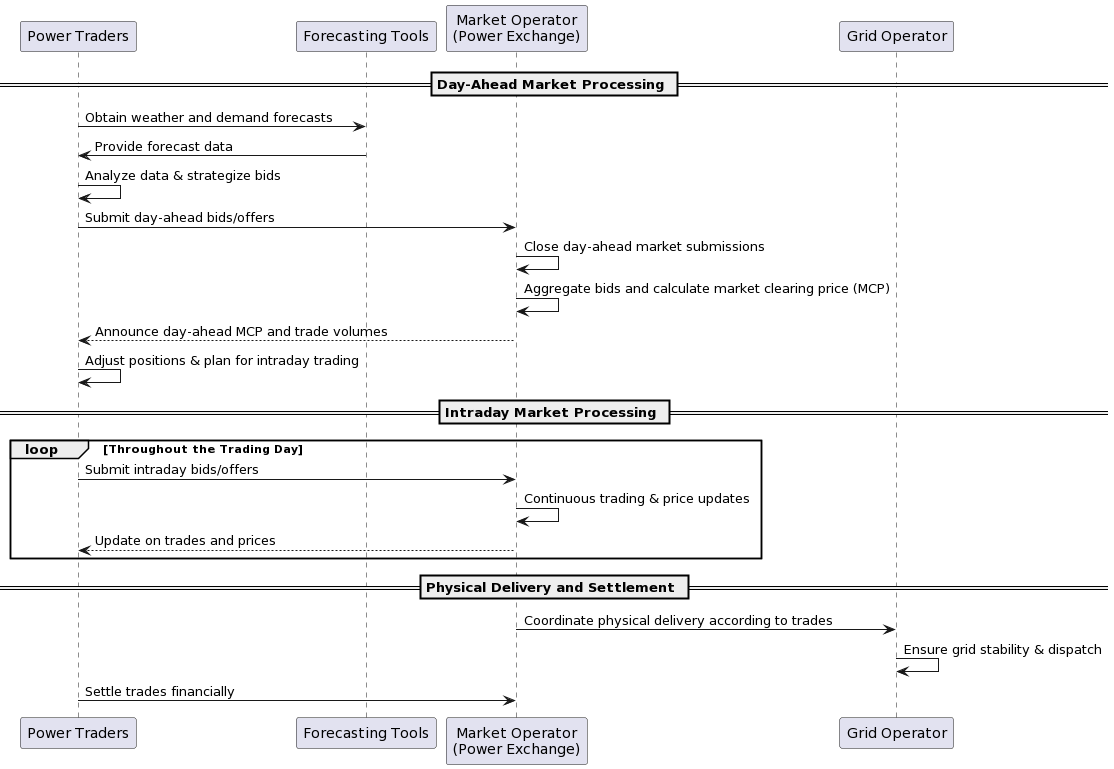

Day-Ahead and Intra-Day Scheduling

Detailed Operations

Automation Opportunities